In the e-commerce shopping season when the "home economy" has fully exploded, are there still opportunities in overseas markets?

Affected by the epidemic, the "home economy" will break out in 2020, and online shopping will increase significantly. Research data shows that online retail has become a new driving force for the growth of the retail industry, with an increase of more than 23% in the third quarter. As the traditional e-commerce holiday peak season, the fourth quarter will be the peak of sales this year. However, it should also be noted that while the scale of the online economy has grown substantially, consumers' online shopping categories/consumption capacity have also been affected by the epidemic. Consumers are more cautious in making large-scale consumption decisions, such as home, health, holiday gifts, etc. Related products may be more popular, and companies need to focus on product promotion.

In addition, we need to be vigilant. At present, there is a "second outbreak" of the European epidemic. The number of cases in a single day has exceeded 100,000. Although the traditional holidays in Europe and the United States are approaching, it is not ruled out that European governments reissued strict blockade policies, which led to the mid to early stage of the epidemic. The phenomenon of "goods hard to sell" has reappeared.

Data source: Baidu real-time map of the epidemic

During the epidemic, the logistics of cross-border e-commerce has been severely affected. The overall logistics cost has risen, but the timeliness is difficult to guarantee. Domestic sellers are preparing for the e-commerce shopping season while also responding to the possible impact of the second outbreak of the epidemic on cross-border logistics. attention.

The epidemic is not clear, cross-border logistics costs continue to rise

Currently, India, the United States, and Pakistan are raging the epidemic, and there has been a second outbreak in Europe. The cost and timeliness of cross-border logistics will continue to be affected. In terms of logistics costs: At present, the price of ocean trunk lines has increased by 3-5 times compared with previous years. With the advent of the peak season and the severe rebound of the epidemic in Europe, the increase in logistics prices will be difficult to predict; in terms of logistics timeliness: insufficient cross-border capacity leads to The delivery of goods is delayed and the arrival time is extended; the epidemic situation in the destination country has caused a shortage of manpower, and various large-scale protests occur frequently, and the timeliness of Amazon warehouse delivery is affected. In this case, the seller can stock up in overseas warehouses or open holiday pre-sales, and arrange the delivery time in advance to ensure the timeliness of the goods to a certain extent. At the same time, seasonal engraved concern European policy changes and other secondary outbreak area, be prepared to once again banned, may be appropriate to transfer some products to other markets, risk diversification.

Although the epidemic has caused uncertainty in cross-border logistics, it has also brought about a blowout of online consumption. Consumers in Europe and the United States who are accustomed to offline shopping in supermarkets have turned to online, bringing a lot of business opportunities.

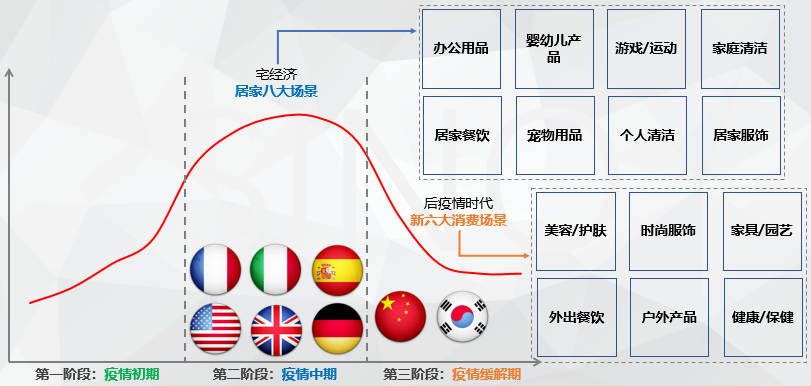

The "home economy" broke out and new consumer demand was stimulated

In 2020, the e-commerce industry accelerates, and a large number of consumers who never shop online have moved from offline to online. According to data from Google and Facebook, more than half of consumers said they will buy more goods this year. X-age and baby boomers have also tried mobile online shopping in large numbers, and the home economy has exploded. The online market is in full bloom, and the focus of consumption has also changed. Research shows that since the epidemic, the demand for household products/clothing, kitchen products, baby products, fitness sports, health care, home office, pet supplies, and other categories has continued to rise. However, the epidemic has affected the financial status of some consumers and their willingness to shop online The increase in price sensitivity at the same time means that the big holiday promotions such as Black Friday and Christmas in the fourth quarter will be more concerned by consumers. During this period, seizing the opportunity to cater to new consumer demand will bring higher returns .

Data source: Google, compiled by Feishu Shennuo Research Institute

The rapid growth of overseas online markets has attracted a large number of companies to join the cross-border e-commerce market. The difficulties in logistics cannot extinguish the enthusiasm of companies to go overseas. However, the choice of the US market by a large number of companies has also made market competition more intense.

E-commerce marketing investment continues to rise, and the cross-border e-commerce market continues to grow hot

1) Focus on North America: Cross-border marketing has increased significantly, and the United States has become the main destination country. The overall marketing investment trend of cross-border companies in 2020 is basically the same as in 2019, but the total investment in 2020 is significantly higher than in 2019. What's interesting is that although the amount of marketing investment has increased significantly, the distribution area is more concentrated. In 2020, the proportion of marketing investment in TOP10 countries will reach 82%, which is an increase of 4.4% year-on-year. The investment in TOP10 countries will all be concentrated in the United States. An increase of 7.9%. Under the epidemic, whether it is a head company or a waist company, the United States, which has a large market and strong consumption power, is still their main choice. At the same time, the US government has repeatedly issued cash to stimulate consumption and cross-border between China and the United States. Factors such as better logistics recovery have also largely affected the marketing choices of companies. For new entrants: entering the more mature but more competitive American market or looking for business opportunities in other markets will be the choice they need to face.

Data source: Feishu Shennuo Research Institute

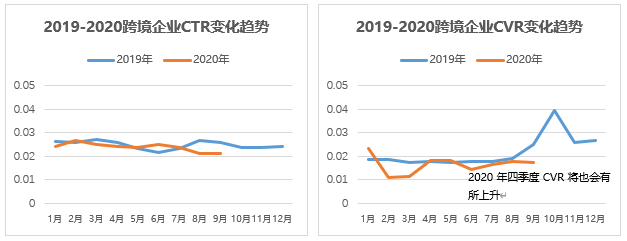

2) Expected growth: CTR and CVR remain stable, and the fourth quarter may usher in a rising period. In the first three quarters of 2020, domestic companies continued to launch overseas markets. In terms of effects, CTR and CVR have basically remained stable. It can be seen that Chinese products are still recognized by overseas consumers during the epidemic. At the same time, with the arrival of the e-commerce peak season in the fourth quarter, compared with 2019, there will be a wave of conversion peaks. Deloitte’s research also shows that e-commerce sales will increase by 25%-35% during the period (November-January). Sellers should Seize the moment, keep on launching, and meet the challenges of the e-commerce shopping season.

Data source: Feishu Shennuo Research Institute

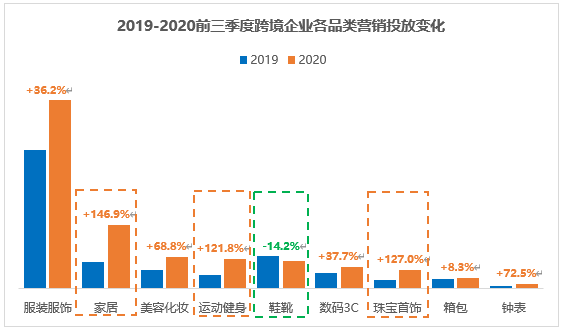

3) Hundreds of flowers blossomed: The investment in various categories generally increased, and only footwear and other products declined. After a brief drop in investment in the first quarter, the investment in most categories rebounded significantly in the second and third quarters. The investment in home economy-related categories such as home furnishing and fitness increased by more than 100%, and only footwear products with significantly reduced usage scenarios declined. Interestingly, categories such as jewellery that should not have been highly used during the epidemic have also seen a substantial increase, possibly because exquisite and bright jewelry can make consumers feel more happy. During the epidemic, some customized jewelry The products are well received by consumers, which makes online jewelry brands that are not particularly expensive also perform well during the epidemic. During the e-commerce shopping season, jewelry as holiday gifts may continue to perform well.

Data source: Feishu Shennuo Research Institute

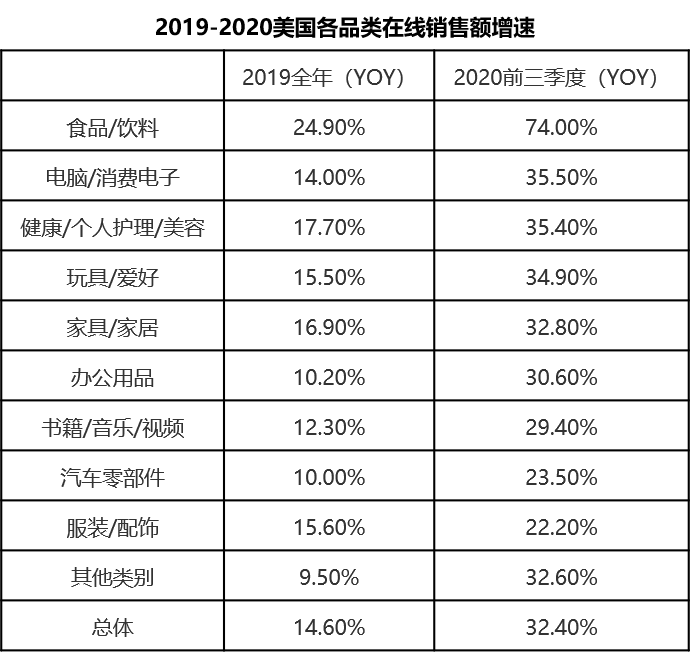

Online sales of various categories are also growing rapidly. Take the US market as an example. In the first three quarters of 2020, the growth rate of sales of all categories is higher than that in 2019. Computers/consumer electronics, office supplies, toys/hobbies, health/personal care Home economy related categories such as /beauty, furniture/home furnishing have increased more significantly, which are also the main categories for overseas companies.

Data source: eMarketer

While overseas marketing companies have substantially increased their overseas marketing efforts, they also need to keep abreast of the new advertising policies issued by overseas media, so that their marketing activities will increase while being accurate and compliant to achieve the best results.

Overseas media policies are becoming stricter, and only by getting familiar with the New Deal in time can you ride the wind and waves

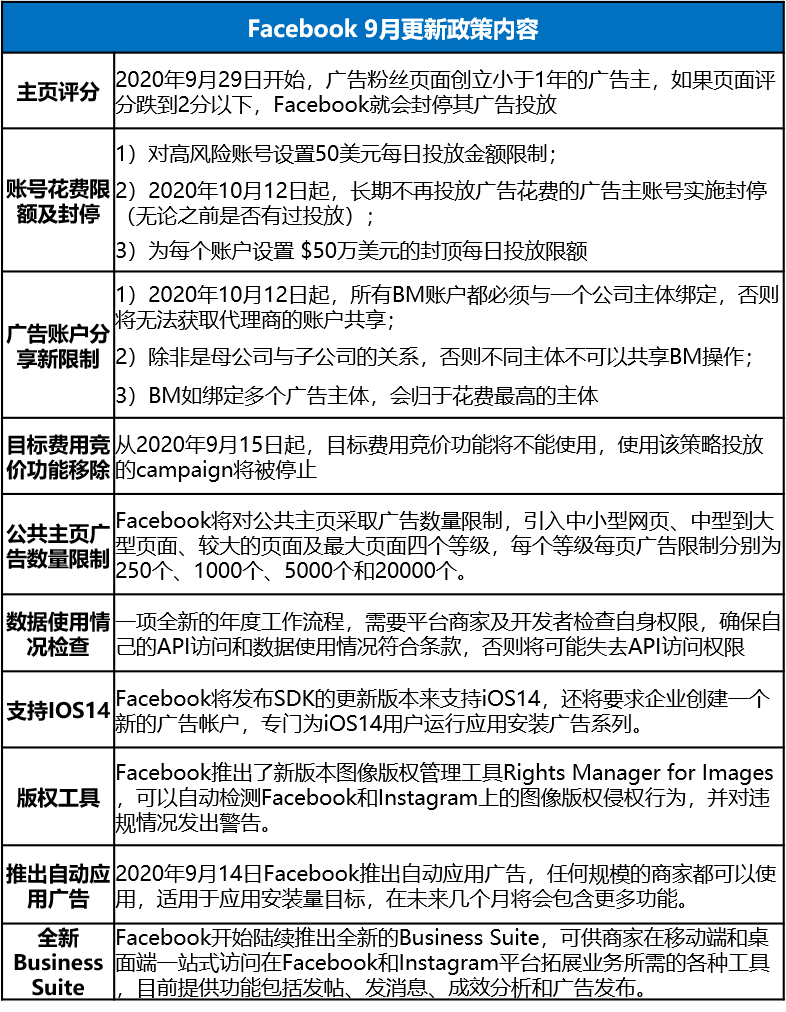

Since September 2020, Facebook has successively issued a number of new policies, involving the homepage, account spending, account sharing, data, tools and other aspects. The New Deal aims to continue to create a safe and credible platform environment, enhance the experience of consumers and advertisers, and improve advertising performance. Companies that go overseas are aware of the content of the New Deal and make targeted changes to prevent such phenomena as suspension. At the same time, make good use of the new tools launched by Facebook to improve advertising effectiveness.

Google’s new policy mainly involves account authentication and permissions, to prevent false propaganda or business opacity, and to facilitate different users to have different permissions for better use and management of accounts.

We can see that although the epidemic has greatly affected the entire cross-border e-commerce logistics link, it still cannot stop the enthusiasm of Chinese e-commerce companies to go overseas. With the east wind of the overseas housing economy, they have set their sights on more mature American market.

However, we also need to realize that with the advent of winter, the current epidemic may have a large-scale secondary outbreak at any time. Companies going overseas should always pay attention to the ban policies in various places; at the same time, a large number of companies gathering in the United States will also bring greater competitive pressure. , The US market itself is already a stock market, and platform e-commerce is facing pressures such as product homogeneity and stricter Amazon policies. New entrants can develop independent stations/developing unique categories, forming differentiated competition, or conducive to better development.

In addition, overseas media policies are becoming more and more stringent, and overseas companies must always pay attention to the red line of compliance while increasing their advertising, and be familiar with the policies while effectively using media tools to improve the effectiveness of marketing.

Comments

Post a Comment